Date:

24/11/2023

Listen to this article:

Key Points

Python in Trading: Known for ease of development, extensive libraries, and flexible API integration.

C++ in Trading: Excels in performance optimization, low-level control, and specialized components for high-frequency trading.

Choice Factors: Strategy complexity, familiarity with the language, and API integration are critical in deciding between Python and C++.

Introduction

Automated trading has become a cornerstone of modern investments, and the choice of programming language is vital for developing effective trading bots. Python and C++ are two leading contenders, each with unique benefits for trading bot development. This article explores the nuances of Python and C++ in the realm of high-frequency trading, offering insights to help you make an informed choice for your specific needs.

Python for Trading Bot Development

Python is celebrated for its simplicity and readability, ideal for rapid development and prototyping of trading bots. Its advantages include:

Ease of Development: Python’s intuitive syntax and high-level abstractions simplify coding complex trading strategies.

Extensive Libraries: Rich library ecosystem, notably 'pandas' for data manipulation, enhances financial data processing capabilities.

API Support: Python's widespread API support with cryptocurrency exchanges and financial data providers streamlines data integration and trade execution.

C++ for Trading Bot Development

C++ distinguishes itself in high-frequency trading with superior performance and control. Its strengths are:

Performance Optimization: As a compiled language, C++ offers enhanced performance, crucial for complex mathematical calculations in high-frequency trading.

Low-Level Control: Fine-grained control over memory management and execution is key for optimizing latency-sensitive operations.

Portability: C++'s portability makes it suitable for trading bots operating under various resource constraints.

Specialized Components: Ideal for implementing critical components requiring fast execution and low latency, which can be integrated into larger Python frameworks.

Factors to Consider When Choosing

Deciding between Python and C++ depends on several factors:

Strategy Complexity: C++ is preferable for intricate logic and high-frequency trading, while Python suits less complex strategies.

Familiarity with Languages: The learning curve and your proficiency in either language influence the decision.

API Integration: Python often has better API support, but C++ provides superior performance for high-frequency trading.

Conclusion

Your choice of programming language for trading bots should align with your trading strategies, performance requirements, and language familiarity. Both Python and C++ have their distinct places in trading bot development, and understanding their trade-offs is crucial for a successful implementation.

About the author

Evalest's tech news is crafted by cutting-edge Artificial Intelligence (AI), meticulously fine-tuned and overseen by our elite tech team. Our summarized news articles stand out for their objectivity and simplicity, making complex tech developments accessible to everyone. With a commitment to accuracy and innovation, our AI captures the pulse of the tech world, delivering insights and updates daily. The expertise and dedication of the Evalest team ensure that the content is genuine, relevant, and forward-thinking.

Related news

Top Gadgets of 2023: Perfect Christmas Gifts for Tech Enthusiasts

Explore the best gadgets of 2023, from VR headsets to smart glasses, perfect for tech-savvy Christmas gift-giving.

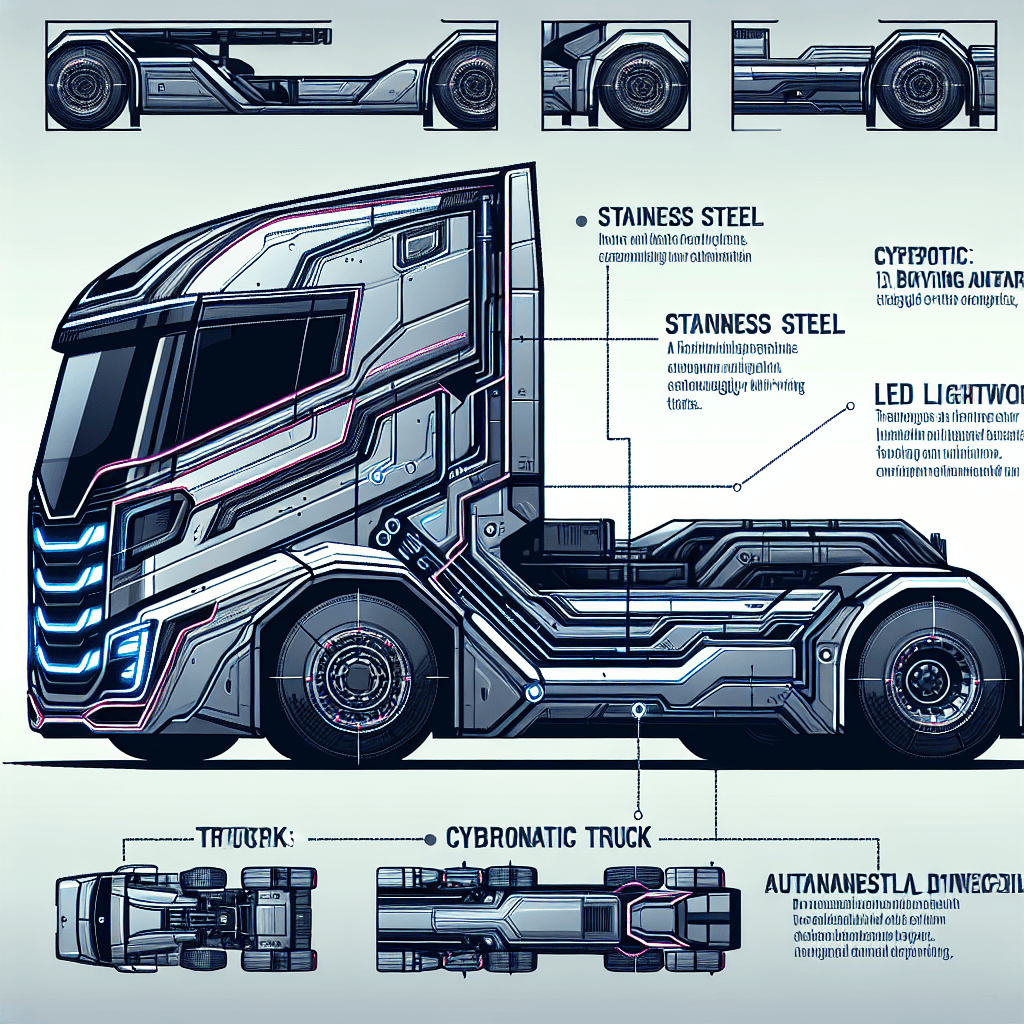

Tesla's Cybertruck: Revolutionizing the Electric Pickup Market

Tesla's Cybertruck is set to redefine the electric pickup truck market with its unique design, advanced features, and powerful performance.

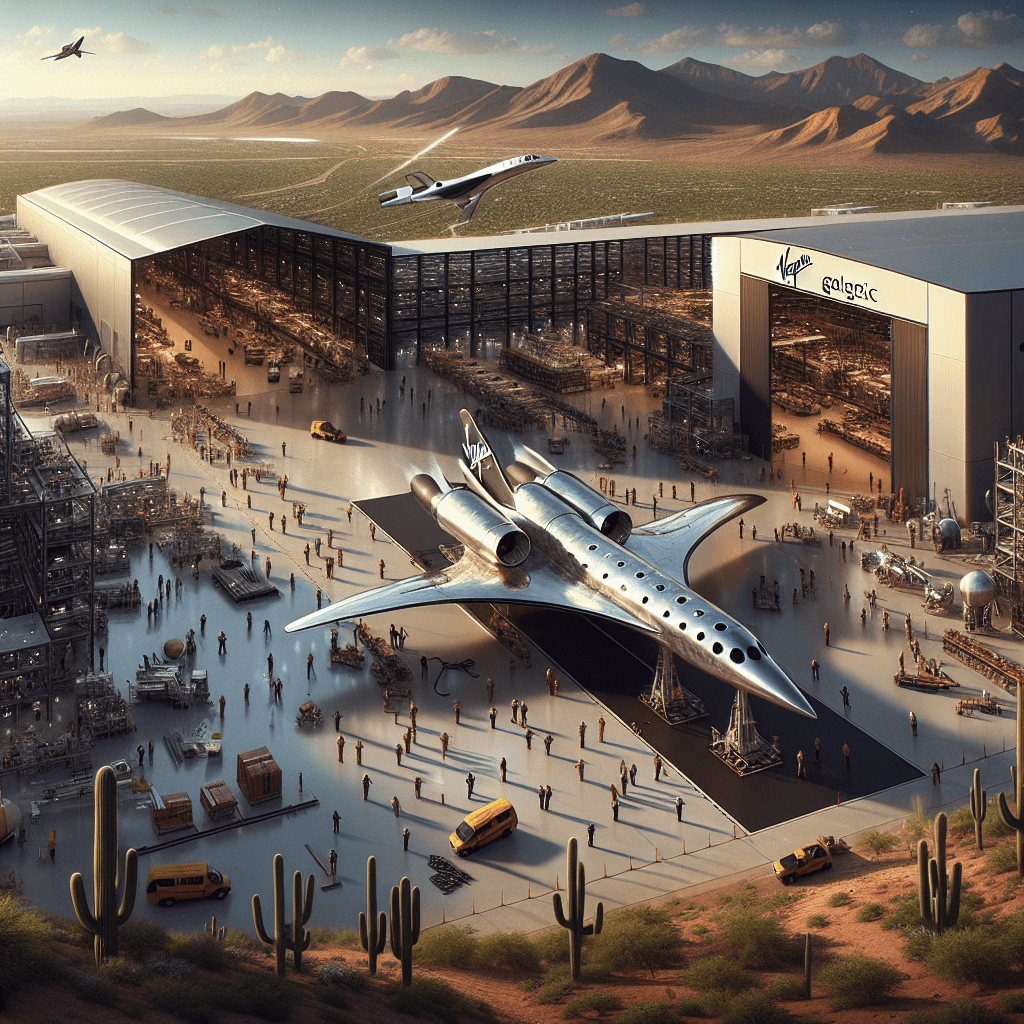

Virgin Galactic's New Spaceship Manufacturing Hub in Arizona

Exploring Virgin Galactic's new state-of-the-art spaceship manufacturing facility in Mesa, Arizona, dedicated to producing the next-generation Delta class spaceships.